What’s the first thing that comes to mind when I say the word budget?

Restriction, holding you back, boring, no fun, buzz killer, difficult, waste of time, hard to do.

Unfortunately the word budget has become associated with negative words. After all, let’s be honest, it’s not exactly like people jump up and down in excitement when it comes to sitting down doing a budget. To some, a root canal may be more fun.

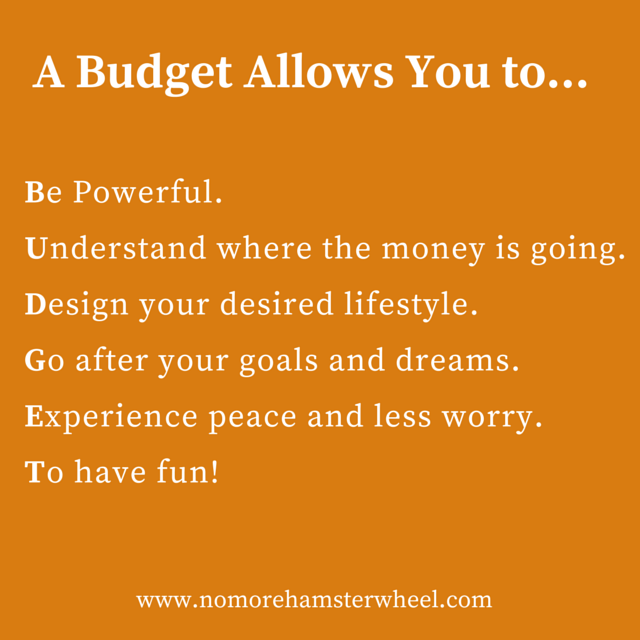

But what if I could show you a different way to think of the word budget? Let’s take a look at my definition of the word budget.

What if we could think of budgeting as providing us freedom instead?

A budget is not a life sentence. The definition for the word budget is: “Estimate of income and expenditure for a set period of time.”

A budget is not there to take all the fun out of your life. Opposite, it’s there to add fun into your life.

When I learned how to budget I realized it was up to me what to include in the budget. I could allocate my money any way I wished. I didn’t have to create my budget based on what others suggested. It was up to me to decide what I was comfortable with.

A budget doesn’t have to follow some standard cookie cutter version. This is your life and therefore your budget. Even if you follow the steps in my book & Financial Freedom course I always suggest you implement what works for you and create your own version.

I don’t want you to stop eating out all the time or having fun. I don’t want you to stop enjoying life or going traveling. That’s not what budgeting is.

Budgeting is simply a way for you to decide where you want your money to go. And once you have a budget in place that you feel comfortable with you can go on autopilot. You have a plan and you don’t have to stress about it every single month. Wouldn’t it be nice to work a little hard now creating a budget so that you don’t have to worry about where your money is going all the time?

Let me explain the autopilot a bit better.

I’m working with this client right now that has $28,000 in credit card debt.

When I asked him how long it will take before he is debt-free he had no idea. I told him if he stopped using his cards, and only paid minimum payment, it would take 13 years. News like that can feel kind of devastating. Why even try to get out of debt?

He could have kept going along thinking getting out of debt was a hopeless thing, right?

Thankfully he has me. I ran the numbers and asked if he could find an extra 50 dollars a month. He said yes. I mean, 50 dollars isn’t that much money. But guess what? That extra 50 dollars a month will get him out of debt in 3 years using the snowball method. You create a plan and then you go on auto pilot.

I’m not asking him to stop living. I’m not asking this person to live on noodles. I’m asking him to find an extra 50 dollars a month somewhere in his budget. Could he get out of debt faster? Of course. But he has other monetary goals too and is fine with the time frame as it allows him to include fun, travel and balance in his life.

The key is – let’s not go so crazy with our money we stop living! Now, I know all of this may seem a bit overwhelming but I hope that every time you hear the word budget you think of it as providing you freedom instead of restricting you.

Are you ready to feel powerful and free by learning about budgeting and money? If so, join my Financial Freedom course. Or do you want to wake up 20 years from now wishing you had?

Great post! Can I use your infographic? It’s perfect.

David Mike recently posted…Home for a Week

Thank you! Glad you enjoyed it. And yes, feel free to use the infographic 🙂